Carbon contracts for difference help de-risk big low-carbon investments by guaranteeing the future value of carbon credits that projects depend on to generate revenue. They can help Canada compete for low-carbon investment.

There’s been rapid progress on carbon contracts for difference since they were first announced in the 2023 Federal Budget, and last month Budget 2024 made substantial new commitments on the file.

- This article is an update on the current status of the federal government’s carbon contracts for difference program.

- It also looks at two important challenges that the program faces: transparency of carbon credit prices, and barriers to access for firms.

- The article highlights how constructive federal-provincial collaboration to overcome these issues can unlock billions of dollars worth of new low-carbon projects across Canada.

First $7 billion was a promising start

The 2023 Federal Budget committed to offering individually-negotiated carbon contracts for difference through the Canada Growth Fund, as well as promising consultations on a broad-based approach.

Clean Prosperity and a group of Canadian industry associations sent a joint letter to Deputy Prime Minister Chrystia Freeland in August 2023 outlining our view of what that broad-based program should look like. We recommended that the government make the program as broad as possible to maximize its potential, be clear about the eligibility criteria, and move quickly to help Canada keep up with the low-carbon investment incentives on offer under the US Inflation Reduction Act.

Later that year, the 2023 Fall Economic Statement allocated $7 billion of the Growth Fund’s $15 billion capitalization to carbon contracts for difference, and clarified that CGF will be the principal federal issuer of carbon contracts for difference.

In December, the Growth Fund signed Canada’s first carbon contract for difference, with Calgary-based carbon capture firm Entropy Inc. The deal — technically a carbon credit offtake agreement — guarantees an initial price of $86.50 per tonne for up to nine million tonnes of Alberta TIER carbon credits generated by Entropy projects over a 15-year term.

The Entropy deal is an important first step, and it holds important lessons for how we can build towards a broad-based program of carbon contracts for difference.

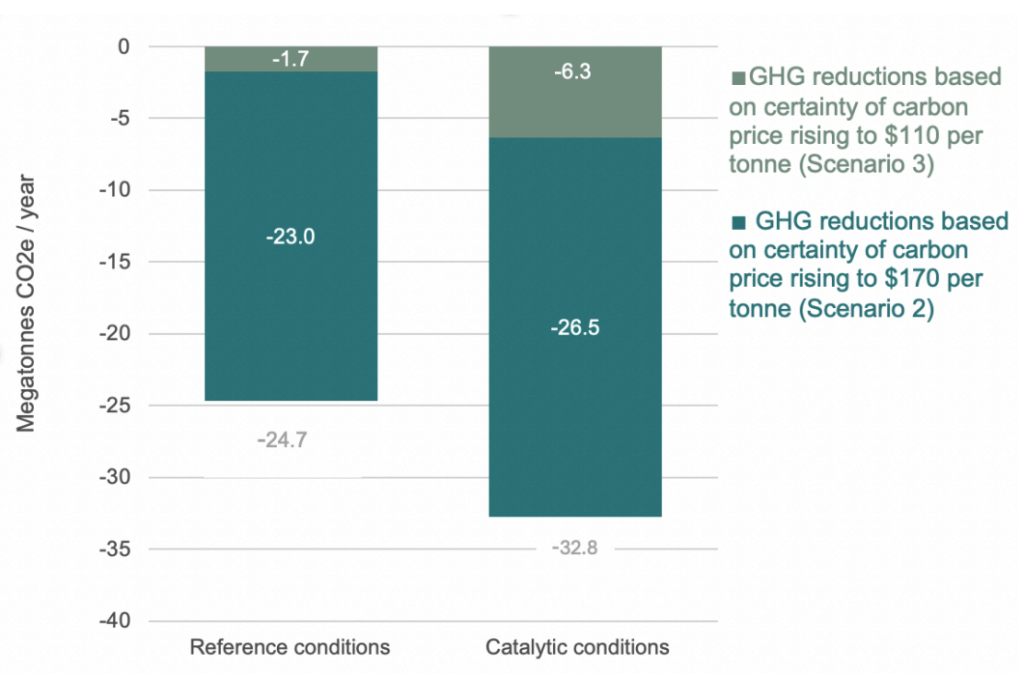

Recent modelling by Clean Prosperity and Navius Research found that Canada could miss out on up to 33 megatonnes of emissions reductions per year by 2030 without a broad-based contracts for difference program. The $7 billion allocated to the Growth Fund can only deliver a small sliver of that much larger pie.

Below: Figure from Clean Prosperity’s Missing Megatonnes report shows industrial emissions reductions that can be achieved by 2030, but only with 100% confidence in the carbon price — provided by broad-based carbon contracts for difference.

Provincial governments agree

In the Alberta government’s 2023 Fall Economic Statement, Finance Minister Nate Horner called for a broad-based carbon contracts for difference program, stating that “in order to spur real investment in decarbonisation, the federal government must make their Carbon Contracts for Difference accessible to major emitters in all sectors.” This call was reiterated in Alberta’s 2024 Budget, and sends a positive signal that there is an opportunity for the federal and provincial governments to work together on contracts for difference.

In addition to the certainty that a broad-based contracts for difference program will bring, the new Alberta Carbon Capture Incentive Program (ACCIP) will support the rapid development of decarbonization and low-carbon projects in the province, and was designed to align with the federal carbon capture investment tax credit. However, the Alberta government is holding back on launching ACCIP until the investment tax credit and a broad-based contracts for difference program are launched. This delay is holding back investment, and needs to be overcome in partnership with the federal government. There is a need for a renewed commitment by both parties to constructively resolve this issue and deploy these necessary supports.

“In order to spur real investment in decarbonisation, the federal government must make their Carbon Contracts for Difference accessible to major emitters in all sectors.”

Alberta Finance Minister Nate Horner

2024 Federal Budget makes big announcements

In Budget 2024 the federal government made significant new announcements about their contracts for difference program, including that the Canada Growth Fund will expand its range of contract offerings. The budget suggests that the Fund could develop off-the-shelf contracts, and offer them on a “competitive basis”. We’d suggest the auctions used to award contracts for difference to UK renewable power producers as a starting point for considering what this competition could look like.

The budget also promised that the program will have the funding required to expand. The government said it “will ensure that the Canada Growth Fund continues to have the resources it needs to fulfill its role as the federal issuer of CCfDs.” This squares with the optimism expressed earlier by Growth Fund CEO Patrick Charbonneau that the government will recapitalize the fund as needed. The intention seems to be to assuage the concerns of project proponents who fear that they’ve missed the boat.

Budget 2024 communicates that the government is looking to be nimble in developing contracts for difference, but that the Growth Fund is building the plane in flight as they figure out how to grow the program to be most impactful.

Lack of market transparency is holding things back

In the 2023 Fall Economic Statement, the federal government made a point of highlighting the challenges of accounting for contracts for difference, which “could expose the government to significant fiscal risks and require upfront recognition of potential costs.” Clean Prosperity has been working with provincial and federal governments to find a way of resolving these concerns so that the federal government can maximize the amount of decarbonization it can underwrite.

One of the challenges with signing derivative contracts tied to the value of carbon credits is that Canada’s industrial carbon markets are opaque. Today, most transactions in provincial output- based pricing systems are carried out over the counter between market participants, with little transparency. While there have been efforts by third parties to increase price transparency (and new ones in the works), it’s almost impossible to sign a contract for difference without an official registry of transaction prices.

It’s possible to guarantee the value of carbon credits with a credit offtake agreement, without the need for market transparency. The Growth Fund structured its deal with Entropy as an offtake agreement instead of a true contract for difference. But this approach has disadvantages, chiefly that the Growth Fund must hold sufficient capital in reserve to backstop the full cost of the offtake deal — even though the Fund intends to eventually turn a profit by reselling the credits it will purchase from Entropy.

The Growth Fund could backstop a lot more decarbonization projects if it didn’t have to hold as much capital in reserve for each deal. Contracts for difference would only require the Fund to hold capital reserves to cover the difference — if any — between the future price of carbon credits and an agreed contract strike price. Contracts for difference offer the government a lot more bang for its decarbonization buck.

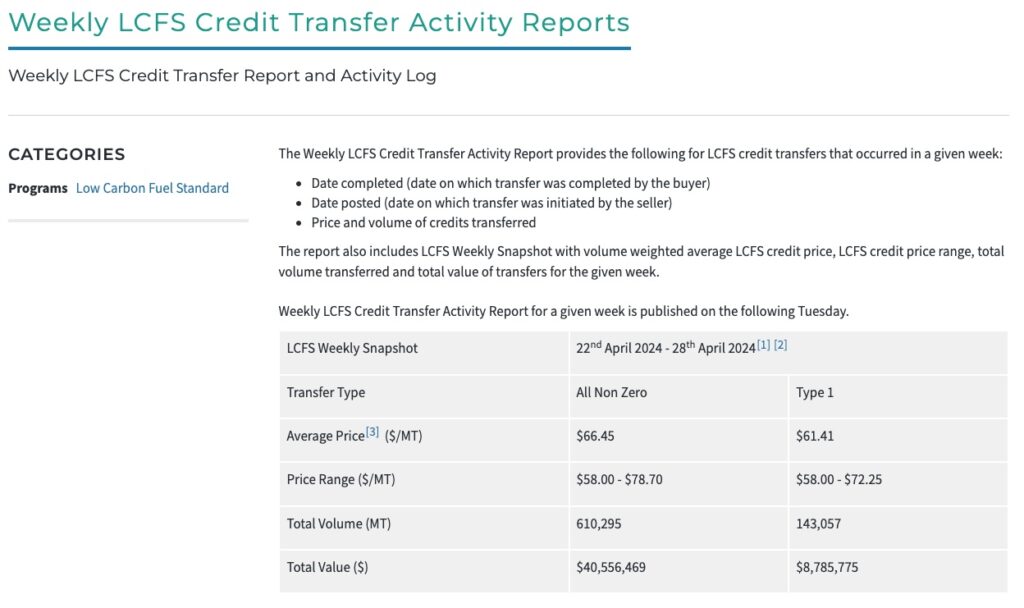

To solve the credit price transparency challenge and create the right conditions to sign contracts for difference, the provinces need to get involved, because they control the carbon markets. There’s a strong incentive for provinces to mandate price transparency — like public reporting of average credit prices, as California does for its carbon market — in order to give firms in their jurisdictions the possibility of benefiting from contracts for difference, and to land the jobs and opportunities that come with low-carbon projects. Increased transparency will improve the functioning of carbon markets, broadly benefiting the growth of Canada’s low-carbon economy.

Budget 2024 confirmed that Environment and Climate Change Canada will work with the provinces to increase market transparency, and we support this effort.

Below: The California Air Resources Board posts weekly average prices of credits traded on its carbon market.

Need to reduce the barriers to accessing contracts

Firms face important barriers to eligibility for carbon contracts for difference that need to be discussed. With the Canada Growth Fund confidentially negotiating bilateral contracts, companies can’t easily determine if their projects will be able to qualify — or even if they match the Growth Fund’s strategic criteria.

Given the uncertainty around the future of carbon pricing in Canada, low-carbon projects that depend on guaranteed carbon-credit revenue to make their business cases may struggle to advance beyond the most preliminary stages of development. More detailed communication from the Growth Fund about their strategic criteria would help here.

We recommend that the Growth Fund publish a memo that describes the design details of their contracts for difference program. This should include details about the types of deals that will be available and the process for accessing them. Ideally the memo should also detail how the Growth Fund plans to move quickly towards standardized contracts.

If the Growth Fund is to move toward a broad-based contracts for difference program, we can anticipate conditions for eligibility that are comparable to those imposed by other countries that offer this de-risking mechanism.

Most significant may be a requirement for Front-End Engineering Design (FEED) studies that attest to the project’s technical and financial feasibility. FEED studies can take years to complete and cost millions of dollars, but they ensure that companies are properly positioned to negotiate with government and have an informed view of their project costs.

The challenge today is convincing a project proponent to invest in a FEED study without any guarantee that their project will be viable following a potential shift in Canada’s carbon pricing system, or that they will be awarded the contract for difference they need to progress to a final investment decision. This could lead to an unfortunate chicken-and-egg scenario where companies are reluctant to invest in FEED studies without upfront certainty that they’ll be able to sign contracts for difference at the end of the process, while the government refuses to certify their eligibility for the program without completed FEED studies in hand.

This challenge isn’t unique to contracts for difference. The Canada Infrastructure Bank started offering concessional loans to support FEED studies for companies trying to launch low-carbon projects, because they encountered similar challenges. Natural Resources Canada and Emissions Reduction Alberta have also committed funding to support FEED studies for carbon-capture projects.

Governments can work to increase access to this kind of early-stage project finance, but companies should also consider increasing their risk appetite in view of the potential rewards that could become available to them with a FEED study in hand.

The challenges are solvable

Carbon contracts for difference promise to be a powerful mechanism for jump-starting low-carbon investment in Canada. But to get a broad-based program off the ground, we need provinces to get more involved by increasing the transparency of their carbon markets, in the interest of helping their firms land contracts. We also need to address barriers to entry for firms so we can grow the pool of companies that are eligible for contracts for difference, and speed up decarbonization.

Over the coming year we can expect the Growth Fund to sign a few more bespoke deals as it evolves its offerings towards a broad-based contracts for difference program.

In order for this evolution to succeed, we need to create the conditions for success as soon as possible, so that carbon contracts for difference are ready to work in tandem with other policy measures, like the federal government’s long-awaited low-carbon investment tax credits. The first of these credits — for carbon capture, utilization, and storage — is expected to receive royal assent before Parliament rises in June. The clock is ticking.