Canada must take urgent action to close the incentive gaps for low-carbon technology investment. We’re at risk of missing out on big opportunities because our investment incentives aren’t competitive with the United States.

That’s the conclusion of new modelling released today in a working paper by Clean Prosperity and The Transition Accelerator.

An update to this research was released in July 2023: explore the updated findings

The working paper is the first attempt to show the dollar value of the incentives offered by the Canadian and US governments for low-carbon technology investment. It looks at seven key technologies, including electric vehicles, solar energy, hydrogen, direct air capture, sustainable aviation fuel, and carbon capture and storage.

“It’s as if Canada is offering companies a coach ticket with the chance of an upgrade, while the Americans are offering to send them straight to first class. But there are strategic moves we can make to fix that.”

Michael Bernstein, Executive Director, Clean Prosperity

“Compared to the United States, Canada isn’t yet a competitive destination for low-carbon investment,” said Clean Prosperity Executive Director and working paper co-author Michael Bernstein.

“It’s as if Canada is offering companies a coach ticket with the chance of an upgrade, while the Americans are offering to send them straight to first class. But there are strategic moves we can make to fix that.”

Last August, the United States’ Inflation Reduction Act (IRA) introduced massive subsidies for a wide range of low-carbon tech, mainly in the form of production tax credits. Canada introduced its own incentives in response, but so far these measures aren’t enough to make Canada as attractive as an investment destination.

However, “There’s an opportunity here for Canada to take advantage of. With a smart industrial policy response to the IRA, Canada can stay competitive and grow a prosperous low-carbon economy,” says co-author and Transition Accelerator Research Director, Bentley Allan.

The working paper recommends that the federal government introduce new measures in Budget 2023 to improve Canada’s competitiveness as a destination for low-carbon investment, namely:

- Carbon contracts for difference, a kind of insurance policy on the future value of carbon credits that will give firms the confidence to make big decarbonization investments.

- Strategic financial support for industries where Canada can compete globally and generate significant economic benefits, good jobs, and manufacturing value added.

Below: How the specific measures proposed by Clean Prosperity and The Transition Accelerator in their new working paper could help close the incentive gap between Canada and the United States.

How contracts for difference could boost blue hydrogen

One industry the working paper examines is blue hydrogen production, which can be produced with low greenhouse gas emissions and offers an emissions-free, affordable fuel for transport trucks, trains, ships, and airplanes.

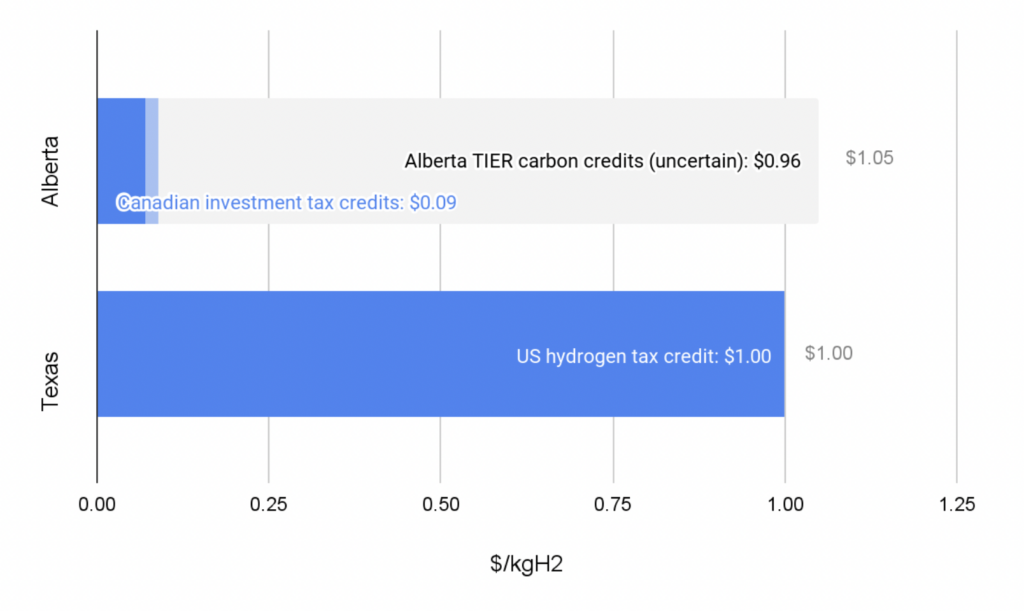

The IRA tax credits are worth about a dollar per kilogram of hydrogen. In Canada, investment tax credits deliver a subsidy of only about nine cents per kilogram — in a best-case scenario, where firms are allowed to benefit from separate tax credits for carbon capture and hydrogen production.

A blue hydrogen facility in Alberta, for example, could become a competitive investment proposition if the federal government guarantees the future value of the facility’s carbon credits using a carbon contract for difference.

With a contract for difference to backstop the value of its carbon credits, the Alberta facility’s guaranteed annual revenues rise from $0.09/kgH2 to $1.05/kgH2:

Average annual revenue incentives for blue hydrogen facilities in Alberta and Texas, 2023-2032 (Canadian dollars)

Strategic financial support: where?

In addition to carbon contracts for difference, the working paper recommends that the federal government provide targeted support in areas where Canada has a strategic advantage.

These are industries where Canada can compete globally and generate significant economic benefits, good jobs, and manufacturing value added. Examples include:

- Direct air capture: A production tax credit for direct air capture could help launch a major new industry that will be critical for meeting our climate targets, while also generating clean economic growth.

- Electric vehicles: The government could fulfil Canada’s ambition of creating a complete mines-to-mobility value chain by complementing existing investments in EV production with incentives for upstream mining of critical minerals and midstream chemical processing.

- Sustainable aviation fuel: With additional public support, Canada has the resources and expertise to develop a significant sustainable aviation fuel industry, which could generate economic benefits in rural communities across the country.

Read the working paper

About Clean Prosperity and The Transition Accelerator

Clean Prosperity is a Canadian climate policy organization. We advocate for practical climate solutions that reduce emissions and grow the economy. Learn more at CleanProsperity.ca.

The Transition Accelerator is a pan-Canadian organization that works to identify and advance viable pathways to Canada’s 2050 climate targets. Learn more at TransitionAcclerator.ca.

For more information

Contact media@cleanprosperity.ca

Photo credit: IMF Photo/Tamara Merino (CC)